Payment system architecture refers to the structural and organizational design of systems that facilitate payment transactions. These systems enable individuals, businesses and institutions to make payments and transfer money, both locally and internationally. The designs address technical components, data and money flows, interfaces, integrations, and security protocols for efficient and secure transactions.

Digital payment systems and cash management are essential for business growth and smooth operations.

Global companies need robust payment systems to handle complex cash flows and multi-jurisdictional operations.

Digital payment systems and cash management are essential for business growth and smooth operations.

Global companies need robust payment systems to handle complex cash flows and multi-jurisdictional operations.

Foster Swiss offers innovative digital payments and cash in-cash out solutions for international companies, improving efficiency and smooth operations in the global business landscape.

Comprehensive process design: Our consultancy covers the total design of the cash in-cash out process architecture.

Currency conversion optimization: If you operate in different currencies, we design solutions that optimize currency conversion to maximize efficiency and minimize associated costs.

Regulatory compliance: We consider and address all legal and regulatory requirements associated with cash flows and transactions, ensuring compliance in all relevant jurisdictions.

Security and resilience: Security is paramount in the design of cash in-cash out systems. We implement robust security protocols and guarantee the resilience of the system against possible threats.

Experience and knowledge: With years in the financial and technology sector, we lead the industry and understand the complexities of digital payments.

Multidisciplinary approach: Our team combines technology, finance and regulation to provide comprehensive and effective solutions.

Customization and creativity: We offer customized and creative solutions, adapted to the uniqueness of each company.

Global partner network: We leverage our network of connections in the financial and technology industry for up-to-date information and collaboration opportunities.

Access channels and transaction processors: We facilitate interactions through POS, mobile applications and other means, managing the authorization and settlement of transactions.

Payment networks and interfaces: We connect banks and payment systems, using APIs to integrate different services in the payment ecosystem.

Security and auditing: We implement security protocols, such as encryption and two-factor authentication, and auditing systems to comply with regulations and prevent fraud.

*We do NOT provide Financial Investment Services of any kind or financial advice – Foster swiss S.A. is an introductory bank management company, the banks we work with have excellent wealth management departments.

Do you know the licenses needed to operate successfully in the Fintech sector?

We improve your technological project from experience

Specific cybersecurity for fintech projects

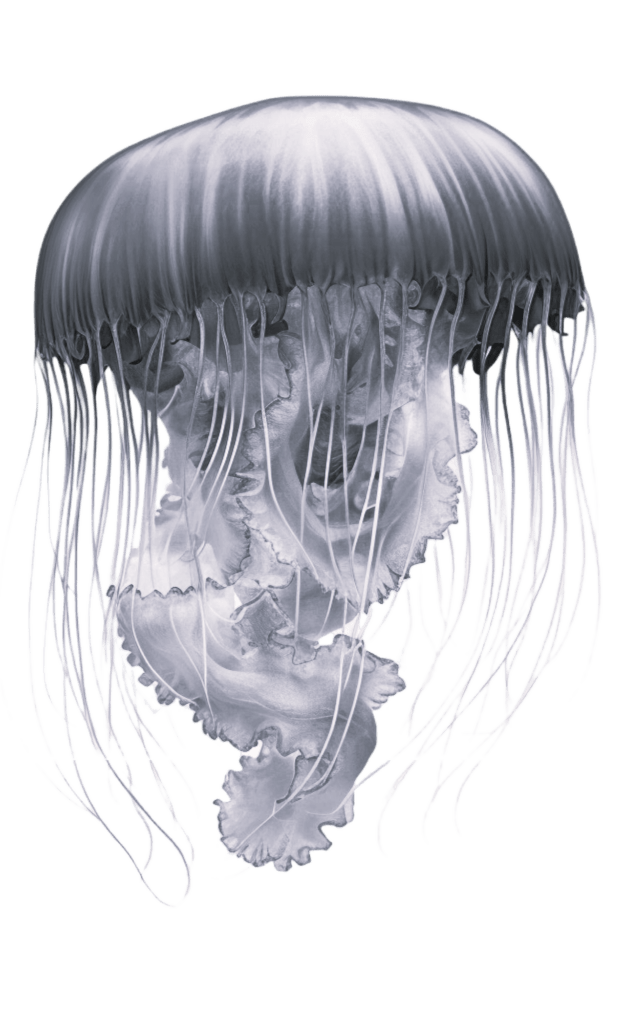

How our passion for the sea meets our dedication to excellence in this exciting sailing project.

Sign up for our Newsletter

Select your preferences and receive the content you are most interested in.

Proactive consulting for visionary organisations.

Foster Swiss does not provide financial advisory or investment management services.

WhatsApp us